- Bhashini

- 0 Comments

- 6495 Views

The financial services industry is undergoing significant changes, driven by a massive $68 trillion wealth transfer from baby boomers to millennials. Consequently, to meet millennials’ high expectations, providers must enhance the speed, convenience, and technological sophistication of their services. Notably, over 50% of millennials, born between 1981 and 1996, state they would switch to a competitor offering a better technological experience. This trend, therefore, is fueling rapid growth in Fintech, impacting banking, digital payments, financial management, and insurance.

GOOGLE MAPS PLATFORM SOLUTIONS FOR FINANCIAL SERVICES

To meet growing customer expectations, Google has launched a suite of solutions for financial services. These tools are designed to enhance security, user experience, and operational efficiency. Furthermore, Google provides technical guidance and specialized APIs for three key financial service solutions:

- Enriched Transactions

- Quick and Verified Sign-up

- Branch and ATM Locator Plus

Additionally, Google offers examples of using APIs in finance for Contextual Experiences and Fraud Detection.

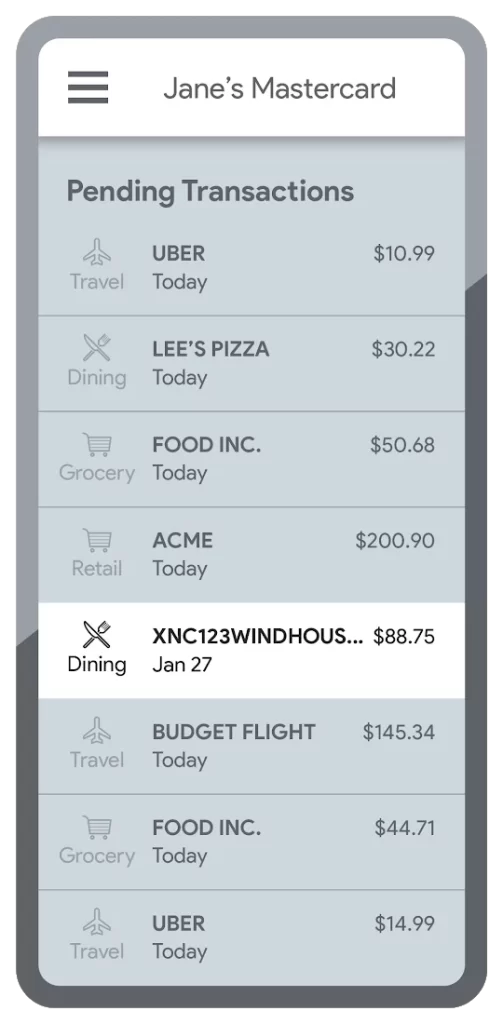

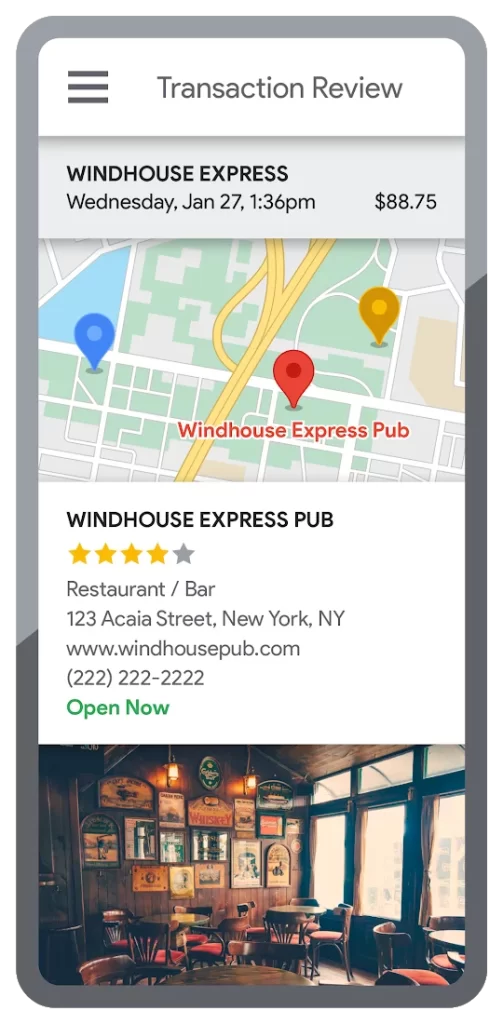

Simplify Transaction History with Enriched Transactions

Customers often find transaction history confusing due to unclear abbreviations like “ACMEHCORP” instead of “Acme Houseware.” Consequently, the Enriched Transactions solution clarifies financial statements by adding vendor names, business categories, storefront photos, map locations, and full contact information. This transparency builds trust, evidenced by a 15% increase in Net Promoter Scores and a 67% reduction in support calls for companies using it.

Additionally, customers can visualize their transactions on Google Maps, including vendor names, amounts, and dates, thereby offering valuable spending insights.

Boost Conversion Rates with Quick and Verified Sign-Up

Manual address entry often results in errors and costly delivery mistakes, reducing conversion rates. Quick and Verified Sign-Up streamlines this process by suggesting addresses after a few keystrokes, cutting registration time by up to 64% and boosting conversion rates by 15%.

This solution also adds an extra layer of address verification, reducing the risk of fraudulent sign-ups. Companies using geospatial data for identity verification see 30% fewer fraudulent accounts.

Implement Quick and Verified Sign-Up to enhance accuracy and efficiency in customer registrations.

Enhance Customer Experience with Branch and ATM Locator Plus

74% of customers research locations before visiting, making detailed profiles essential. Branch and ATM Locator Plus integrates comprehensive information from Google Maps into your website and apps, including opening hours, services, user ratings, photos, and directions.

Financial service providers using this solution report a 14% increase in NPS and a 7% decrease in support calls. Ensure your customers easily find and trust your branch and ATM locations with Branch and ATM Locator Plus.

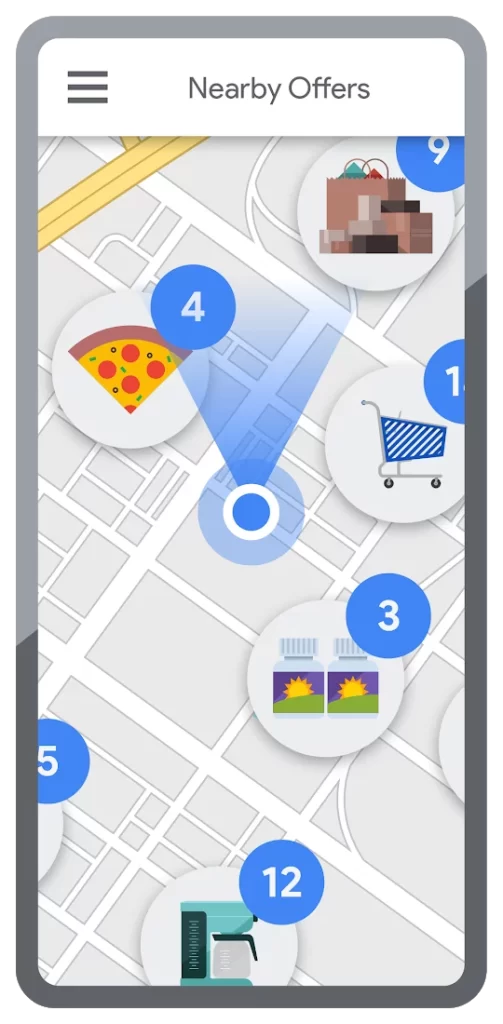

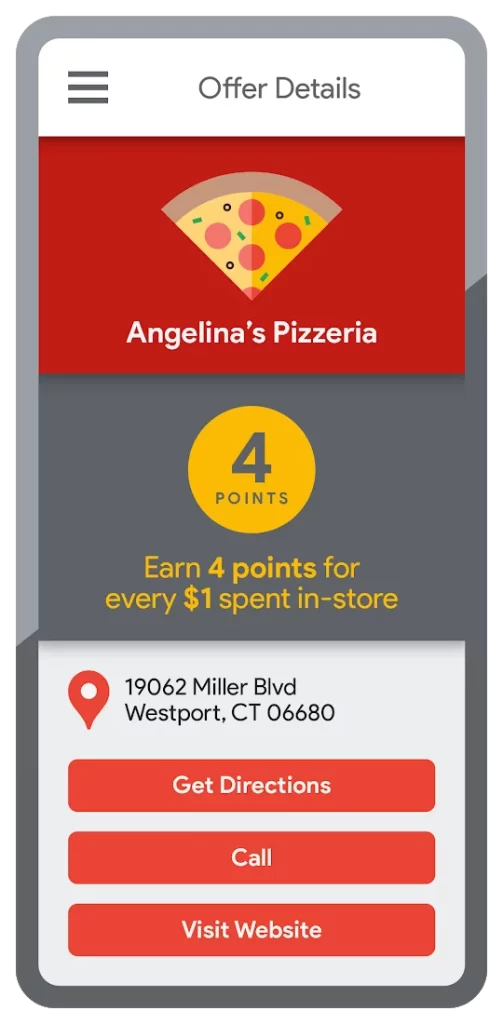

Elevate Engagement with Personalized Offers and Rewards

Drive customer engagement with real-time, geo-targeted offers showcased on Google Maps. Leveraging transaction insights and customer consent for location-based features, the Contextual Experiences solution enables personalized deals and reward programs, fostering deeper engagement.

This approach yields tangible benefits, including an 8% increase in NPS and an 8% extension of app user engagement time. Optimize customer interactions and loyalty with tailored rewards and incentives.

Enhance Security with Fraud Detection Solutions

Leverage customer mobile device locations, obtained with consent, to detect potentially fraudulent activities based on geographic distance. For instance, the system can flag ATM withdrawals far from the customer’s smartphone location. Additionally, Google APIs can pinpoint sequences of suspicious transactions, like purchases made at distant physical stores.

Financial institutions utilizing geospatial data for customer identity verification have reported a significant decline of about 70% in fraudulent transactions and a reduction of false positives in fraud detection by roughly 45%. Strengthen your fraud prevention measures and safeguard customer assets effectively.

Solutions described above increase customer experience quality as well as improve security and convenience of financial services. If you need help to implement any of the Google services, contact us! As a Google Premier Partner, we will help your company to develop its financial technology.